ALL YOU NEED TO KNOW ABOUT TELEWORKING IN 2024

Telework has become the common form of organization of work for many Luxembourgish and border workers. Today, this is possible thanks to the derogatory agreements signed between the Luxembourg and border authorities concerning the applicable social and fiscal rules. They thus allow employees in teleworkable jobs to carry out their duties from home without impacting their payslip.

In order to keep you up to date with the ever-changing regulatory environment you will find below the answers to your questions regarding telework, from its set-up to its implementation.

1. In terms of social security, what are the limits to teleworking ?

The European Regulation on the coordination of social security (EC 883/2004) lays down a general principle that an employee should only be affiliated in one state.

The important criterion laid down by this Regulation is the substantial activity of the employee in his country of residence. When an employee works at least 25% of his working time and/or receives 25% of his remuneration in his country of residence, all remuneration received in the different countries is subject to a single social security scheme, that of his country of residence.

Therefore, teleworking days add to this 25% limit, thereby limiting the possibilities for frontier workers to telework if they want to remain affiliated to the Luxembourg social security system.

In view of the explosion in teleworking in recent years, which has now become an "ordinary" way of working, the Member States of the European Union wanted to authorise frontier workers to telework a greater number of days without risking a change in social security system. The EU Member States have drawn up a framework agreement allowing, under certain conditions, cross-border workers in Luxembourgish companies who spend up to 49% of their working time in their country of residence to remain subject to Luxembourg social security system. Concluded for a 5-year term this framework agreement came into force on 1 July 2023.

From now on, on request, non-resident employees may telework up to 49% of their time provided the following cumulative conditions are met:

- the Member State of the employer's registered office/place of business and that of the employee's residence must have signed the framework agreement. To date, Belgium, Luxembourg, France and Germany have signed it. The list of signatory Member States can be found at Télétravail transfrontalier dans l'UE, l'EEE et la Suisse | Service Public Fédéral - Sécurité Sociale (belgium.be)

- telework must be carried out exclusively in the Member State of residence;

- the telework activity must be between 25% and less than 50% of the total working time;

- the connection to the employer's IT infrastructure must be possible;

- the employee must not be carrying out another activity (employee with the same employer / employee with another employer / self-employed) in his or her Member State of residence or in any other Member State.

If the limit (25% or 49% depending on the case) is exceeded, the Luxembourgish company will first have to register as a "foreign company" with the foreign social security institution. It will then have to pay the employer's contributions of this foreign country, which are higher than in Luxembourg. As for the employee, he or she will now benefit from the social security coverage of his or her country of residence (and no longer from that of Luxembourg). Switching to a social security system other than that of Luxembourg implies significant increases in social security charges for the employer.

|

Contribution rate |

Luxembourg |

Belgium |

Germany |

France |

|---|---|---|---|---|

|

Employer’s share |

+/- 13% |

+ 27% |

19.60% |

+ 45% |

|

Employee’s share |

12.45% |

13.07% |

19.60% |

+ 25% |

2. When and how should cross-border teleworkers be declared?

Since April 2, 2024, new procedures have come into force for declaring any professional activity abroad, regardless of the reason (telework, business trips, training, secondment, multiple jobs, etc.).

Therefore, as soon as a non-resident employee teleworks, their employer must submit an electronic declaration via SECUline (DEMDET procedure) or a paper form "Exercise of regular activities in two or more Member States (multiple jobs)" to the Joint Social Security Center (CCSS).

This declaration must be made regardless of the percentage of telework carried out (less than 25%, between 25% and less than 50%, and more than 50% of working time). However, the declaration shall not be done for each individual day of telework. It must relate to a projected period that the employer chooses to determine on a case-by-case basis.. The percentage to be declared is calculated on the basis of a monthly average of telework. For example: 40% teleworking from 1 September 2023 to 31 December 2024. Be careful, any change likely to affect the situation of an employee is important and must be reported by the employer in a new declaration.

Please note that there is an additional reporting obligation for employees residing in Belgium, whose teleworking must also be declared via LIMOSA to the National Social Security Office.

3. Is an A1 certificate necessary for border workers who telework?

In application of European rules, as soon as an employee is required to work temporarily or partially outside Luxembourg, it is necessary to obtain the A1 certificate attesting to the social security regime applicable to the worker. Because he or she teleworks in his country of residence, the non-resident employee is in a situation of international employment. He is therefore concerned by this administrative formality.

In order to be issued with the A1 certificate, it is necessary to have first requested (and obtained) a Décision de Législation Applicable (DLA) [applicable legislation decision] from the social security organization of the country of residence, i.e. from the URSSAF for France, the ONSS for Belgium and the DVKA for Germany.

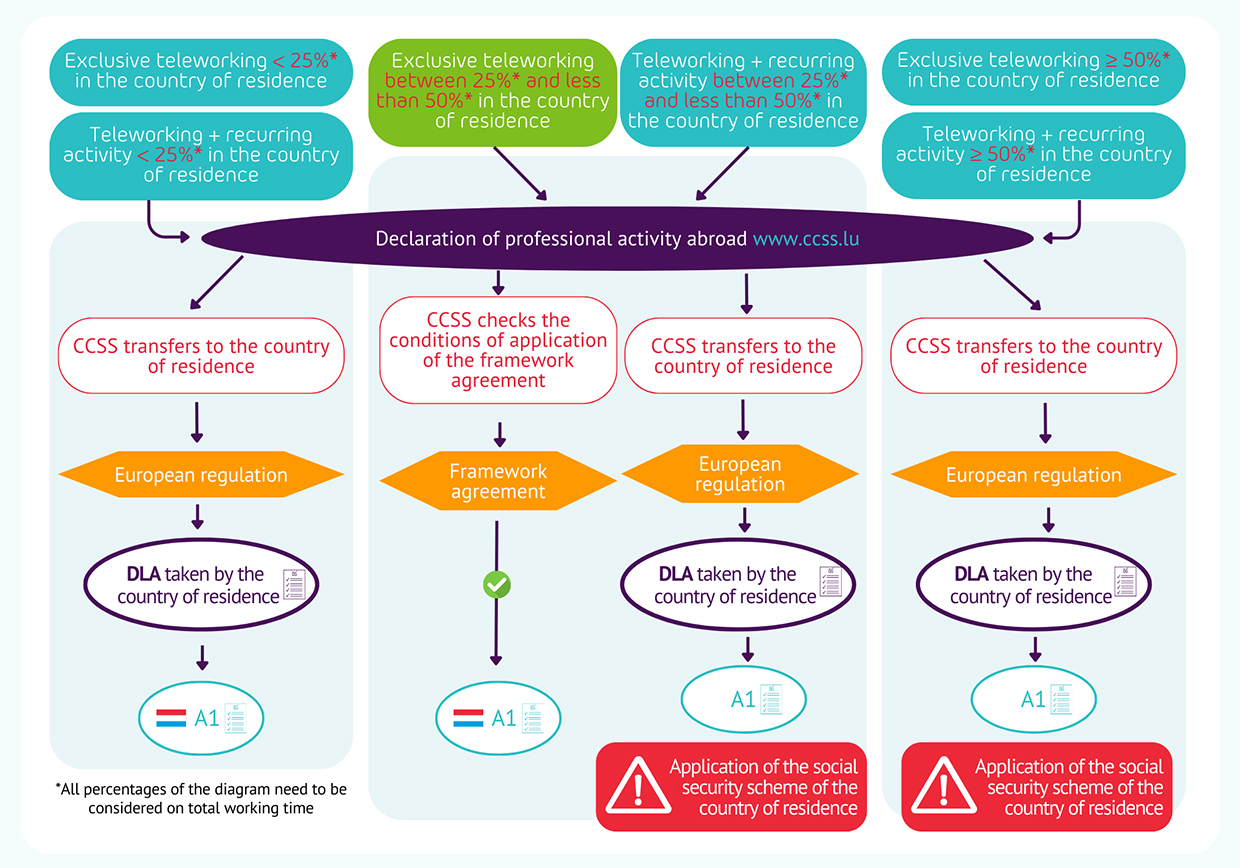

Once the employer has declared telework (see question 2 above), there are two possible scenarios :

- The teleworking activity falls within the scope of the new framework agreement

In this case, once the conditions of application of the framework agreement have been checked (see question 1 above), the CCSS will be able to issue the A1 certificate directly, confirming that the Luxembourgish social security scheme will be maintained. DLA is not necessary in this case.

- The teleworking activity does not fall within the scope of the new framework agreement

The usual European provisions on the coordination of social security apply here and the social security legislation that applies must be determined by the Member State of residence. The CCSS will then turn accordingly to the competent social security body in the employee's country of residence to issue a Décision de Législation Applicable (DLA). This DLA will therefore indicate the social security scheme applicable to the employee, and the social security body thus designated (the CCSS or the social security body in the country of residence) will issue the A1 certificate.

See scheme under question 2

4. In terms of taxation, what are the limits to teleworking ?

Since 1st July 2022, the derogatory agreements concluded by Luxembourg with neighbouring countries have not been extended. Consequently, the tax tolerance thresholds provided for in the double taxation agreements will have to be respected, namely :

- Threshold of 34 days for French residents ;

- Threshold of 34 days for German residents ;

- Threshold of 34 days for Belgian residents.

These tolerance thresholds allow non-resident employees working for a Luxembourgish employer to work outside Luxembourg occasionally without triggering taxation in their country of residence. In other words, below the above-mentioned thresholds, frontier workers can telework without being taxed.

When calculating these tolerance days all days worked outside Luxembourg, whether in teleworking, training or on business trips should be taken into account.

Furthermore, each fraction of a day worked outside Luxembourg counts as a full day. Thus, an employee who teleworks for 2 hours from home before going to the office has his or her quota reduced by one day, even if he or she has not worked a full day from his or her country of residence.

The days worked outside Luxembourg must be monitored on a monthly basis. As the employer is responsible for the correct deduction of tax at source on the payslips of the employees, the correct tracing of days outside Luxembourg becomes mandatory. At the same time, such monitoring provides the employee with a real-time view of his or her quotas and to anticipate whether or not the tax and social security limits have been exceeded.

If the above-mentioned thresholds were to be exceeded, all days worked in the country of residence in the framework of telework would be taxable in that country (and no longer in Luxembourg), starting from the first day (see question 7 below).

5. What about part-time border workers? Do they benefit from the same limits in terms of taxation and social security?

In the case of part-time work, the tax tolerance threshold is to be prorated for border workers who are residents in France. The rounding off into a number of full days is done downwards. For example, a part-time French employee will benefit from 14 days of telework without being taxed in his country of residence.

For border workers who are residents in Belgium, the tax tolerance threshold does not have to be prorated in case of part-time work according to the clarifications made by the Direct Tax Administration on August 26, 2022. However, this clarification has not been validated by the Belgian authorities (who had adopted position in favour of prorating with up-rounding in an administrative circular of 2015). It is therefore strongly advised to apply prorating (see question 6 below).

For border workers who are residents in Germany, the tax tolerance threshold does not have to be prorated in case of part-time work.

As far as social security is concerned, the limits of 25% / 49% of working time are assessed on the basis of the time worked, increased by sickness/maternity days and reduced by leave days. Consequently, these limits must be prorated for part-time workers.

6. How are the tolerance thresholds applied as of 2024?

|

|

Belgium |

Germany |

France

|

|---|---|---|---|

|

Tolerance threshold |

34 days |

34 days |

34 days |

|

Calculation of the threshold in case of part-time work |

Prorated according to the time worked under the contract (The rounding off into a number of full days is done upwards). |

No prorating |

Prorated according to the time worked under the contract. (The rounding off into a number of full days is done downwards). |

|

Calculation of the threshold in case of activity only part of the year |

Prorated according to the number of months (any month started counts as one month) |

No prorating |

Prorated according to the length of occupancy |

|

Taking into account days worked partly in Luxembourg and partly in the country of residence or in a third country |

Any fraction of a day worked partially outside Luxembourg, even for a short period, counts as a full day |

Any fraction of a day worked partially outside Luxembourg counts as a full day |

Any fraction of a day worked partially outside Luxembourg counts as a full day |

|

Taking into account the days or fractions of days of training outside Luxembourg |

Any day or fraction of a day will be considered as of an activity day |

Any day or fraction of a day will be considered as of an activity day |

Any day or fraction of a day will be considered as of an activity day |

|

Taking into account days or fractions of days of on call |

Yes (considered as working days) No distinction between passive on-call duty and effective work during on-call duty |

Yes (considered as working days) No distinction between passive on-call duty and effective work during on-call duty |

Not specified in the agreement |

7. If the tax threshold is exceeded, how should teleworking income be treated ?

If the tax thresholds are exceeded, the salary relating to all the days worked outside Luxembourg will in principle be taxable in the employee's country of residence. Only the days worked in Luxembourg will be taxed in Luxembourg. As a result, the payroll will have to be adapted to exempt days worked outside Luxembourg from Luxembourg tax withholding.

In France, as of January 2023, the Luxembourg employer must declare once a year the taxable income in France of the employees having exceeded the tax threshold to the French administration. This declaration must be made in January of the following year via a PASRAU declaration, which implies that the Luxembourg employer must have a SIRET number in France. This annual declaration only applies to employees who remain subject to Luxembourg social security. On his side, the French resident will be responsible for the payment of the income tax related to the telework. Therefore he will have to support monthly an advance payment, after having made the necessary steps directly online on his personal space DGFIP.

For the Belgian resident, the withholding tax is in principle not compulsory. Therefore, the Belgian tax resident employee will have to declare all his or her income including telework income in his personal tax return and will be taxed accordingly. Note that Luxembourg employers are not required to withhold tax in Belgium, unless they have a permanent establishment there.

Finally, the German resident employee will have to declare all his or her income including telework in his personal tax return and be taxed. It should be noted that there is no withholding tax requirement in Germany for the Luxembourgish employer.

8. How follow up the authorized telework days?

As an employer, you are free to set up any means of validating or monitoring your employees' teleworking days. In most cases, this will be done through your time/leave management tool. Initially, human resources will need to create a teleworking day counter based on the employee's residence, working hours or internal company policy.

In a second step, the employee will have to make a telework request and get a validation from his manager. Thus, in the same way as the employee's leave counter, the telework counter will be adjusted at each request. This will allow both parties to have visibility on the number of remaining telework days and especially to refuse a telework request once the quota of days is exhausted.

Be careful, if your employees also travel abroad, you will have to think about creating another counter and taking these days into account for the calculation of the thresholds. Indeed, all work performed outside Luxembourg should be included in these tolerance thresholds (e.g.: training sessions outside Luxembourg, customer visits outside Luxembourg, visits to the head office...).

9. What proof can be provided in case of inspection?

In case of control by the competent authorities of the teleworker’s country of residence and in order to guarantee a greater legal security to all parties concerned, frontier workers are strongly advised to provide proof of their physical presence on Luxembourg soil. This proof can be done by any means and in particular by the following documents:

- The employment contract or a certificate from the employer mentioning the functions performed and the place where they are performed;

- Nominal time sheets for hours worked;

- Nominal transportation documents (train or bus tickets, etc.);

- Nominal invoices related to accommodation expenses (hotel, car rental);

- Attendance lists for meetings or training courses;

- Documents related to material purchases or catering expenses in the state of activity (credit card bills, receipts);

- Travel orders by name;

- And any other relevant documents.

10. Does a home office policy need to be drawn up?

In Luxembourg, the implementation of this form of work is not subject to a collective agreement or internal regulations applicable in the company. A home office policy is therefore not strictly necessary in and of itself.

Such a document can be extremely useful, however, as it makes it possible to spell out the implementation of telework in the company in detail, particularly the places where telework is feasible (home, public spaces, countries other than the country of tax residence, etc.), the employees concerned/excluded, the tax and social limits defined by the company, etc. This policy could also usefully address the right to disconnect and recall the rules on personal data protection.

11. Should an amendment to the employee's contract of employment be drawn up?

When telework is occasional, the employer provides the employee who has requested to telework with a simple written authorization (in the form of an email or SMS).

Telework is considered occasional when it:

- is carried out to deal with unforeseen events and/or;

- represents less than 10% (approximately 20 days for a full-time employee over a 12-month period) on average of the teleworker's normal annual working time.

In all other cases, when the telework is regular on the other hand, various elements must be defined by mutual agreement in writing between the employer and the employee:

- the place of telework or the procedures for determining this location;

- the hours and days of the week during which the teleworker teleworks and must be reachable for the employer or the procedures for determining these periods;

- the procedures of possible compensation in terms of benefits in kind;

- the monthly flat rate for connection and communication costs;

- the procedures for the transition or return to the traditional work arrangement.

This written agreement may take the form of an amendment or an employment contract for newcomers, but it does not have to. The different elements mentioned above can in fact just as well be determined in the framework of the specific telework regime defined at sector or company level.

In other words, the amendment to the contract is not strictly necessary in case of regular telework as long as a telework policy is established internally within the competence of the staff delegation (see question 12 below). However, it seems important to us that the employer can make sure that the employee is fully aware of his or her rights and obligations in terms of telework. The employee could therefore be asked to sign an acknowledgement of receipt in which he or she undertakes to respect the home office policy.

12. Does the staff delegation have a role in the implementation of telework?

According to Articles L.414-1 ff. of the Labour Code, the staff delegation must be regularly informed about the number of teleworkers and how it changes in the company.

When there is a staff delegation, the introduction or modification of the specific telework scheme is done after information and consultation of the staff delegation when the company has fewer than 150 employees.

In companies with at least 150 employees, there must be a mutual agreement by and between the employer and the staff delegation.

13. Should a fixed "telework" allowance be paid to the teleworking employee?

The answer differs depending on whether telework is regular or not. When the telework is occasional, the employer is not required to provide such an allowance.

Telework is considered occasional when it:

- is carried out to deal with unforeseen events and/or;

- represents less than 10% (approximately 20 days for a full-time employee over a 12-month period) on average of the teleworker's normal annual working time.

In all other cases, when it is regular, the employer provides the work equipment necessary for telework and pays the costs directly generated by telework, in particular those relating to communications. This can be done by allocating a monthly lump sum, to be agreed in writing between the employer and the employee.

By way of illustration, the collective agreement applicable to employees in the banking sector provides for a fixed sum of approximately €27.64 (index 921.40) per month to be paid by the employer.

The Administration des Contributions Directes [Luxembourg Inland Revenue] explicitly states on its website that this type of fixed allowance for regular telework is taxable.

SECUREX AT THE READY TO ASSIST YOU

Securex is on hand to support you with the implementation of telework. Our HR consultants will inform you of the issues at stake and make you aware of the HR challenges that this particular mode of work organization represents. Our legal team will answer the legal questions raised by the new telework agreement, and assist you in drafting a customized policy.

Then, in the month to month implementation, our payroll consultants will assist you with the follow-up and determination of the tolerance threshold, as well as in the registration of the Luxembourg company with the foreign authorities. They will ensure that the withholding tax is calculated correctly and coordinate, if necessary, the payroll management with the payroll providers of the border countries (tax exemption/withholding tax according to the rules of the country of residence).

With our services, our expertise and our international partnerships, you can rest assured of complying with your tax obligations and a correct calculation of the salaries while being able to anticipate the tax and social consequences relating to the teleworking of your employees.

For more information, please contact Virginie Echelin: @email